The Financial Forecast Center is a leading independent resource for accurate, data-driven forecasts across a wide spectrum of financial and economic indicators.

Utilizing artificial intelligence, FFC provides regularly updated projections for interest rates, exchange rates, stock indexes, inflation, and other key economic metrics.

| As of February 18, 2026 | |||

|---|---|---|---|

| Indicator | Current | Forecast for February |

Forecast for March |

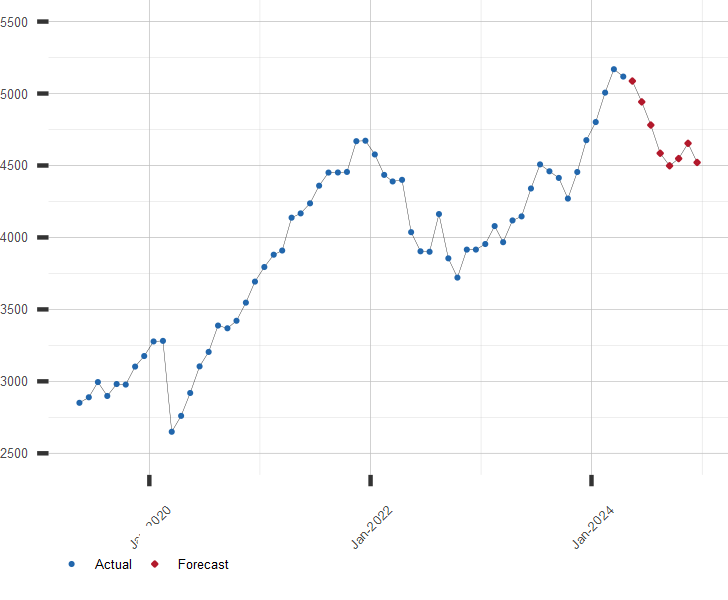

| S&P 500 | 6881.31 | 6888 | 7074 |

| 30 Yr Treasury | 4.71 | 4.81 | 4.95 |

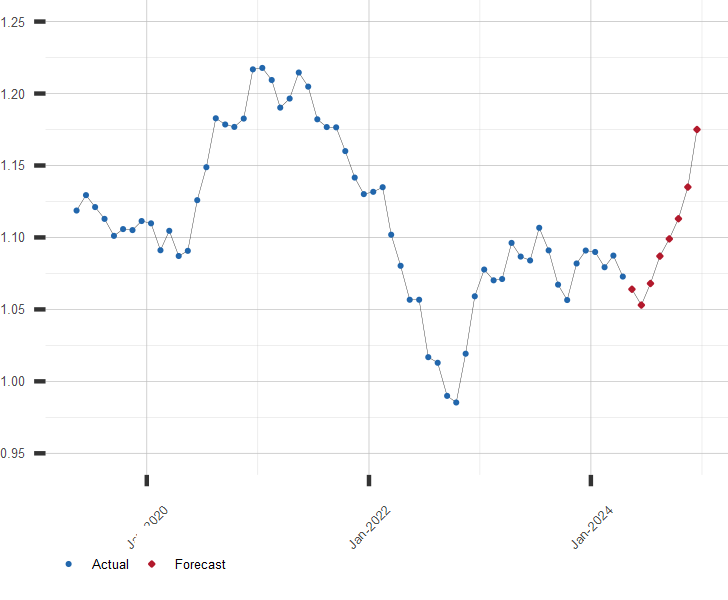

| EUR to USD | 1.179 | 1.187 | 1.180 |

| GBP to USD | 1.350 | 1.361 | 1.358 |

| CAD to USD | 1.370 | 1.368 | 1.371 |

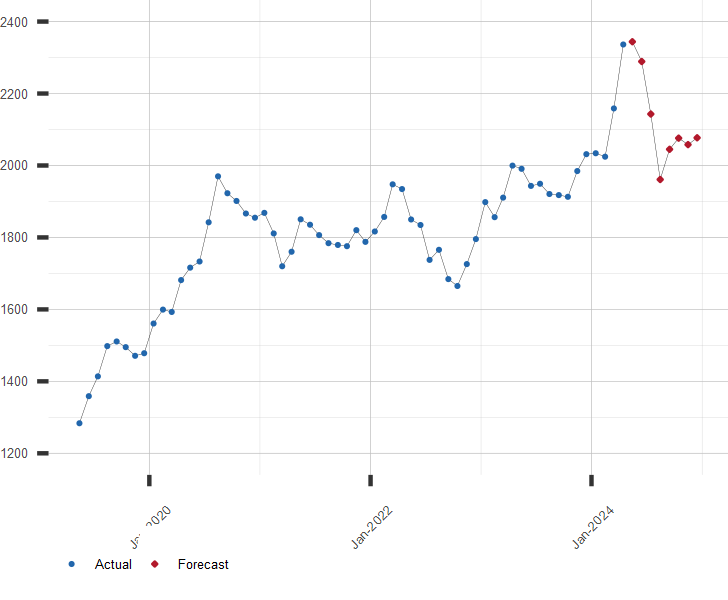

| Gold Price | 4982.80 | 4955 | 5186 |

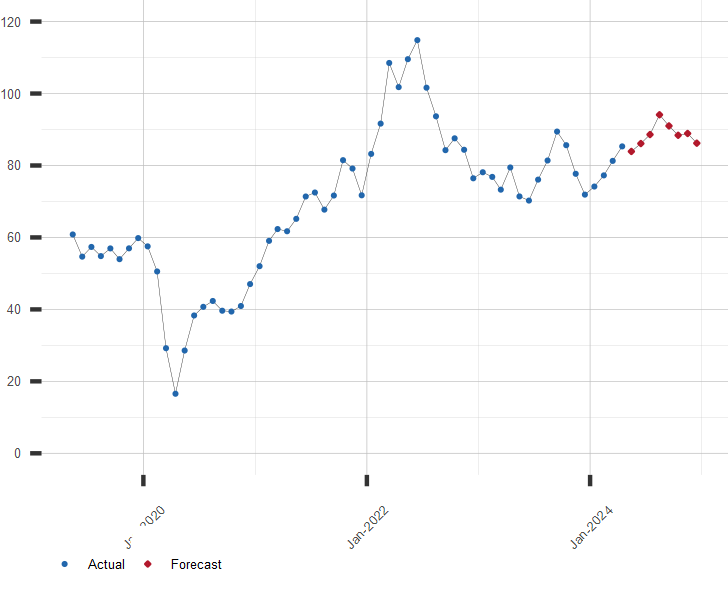

| Crude Oil Price | 65.31 | 63.2 | 61.1 |

Popular Forecasts

S&P 500 Forecast

EUR/USD Forecast

Gold Price Forecast, USD/t oz

WTI Oil Price Forecast, USD/BBL

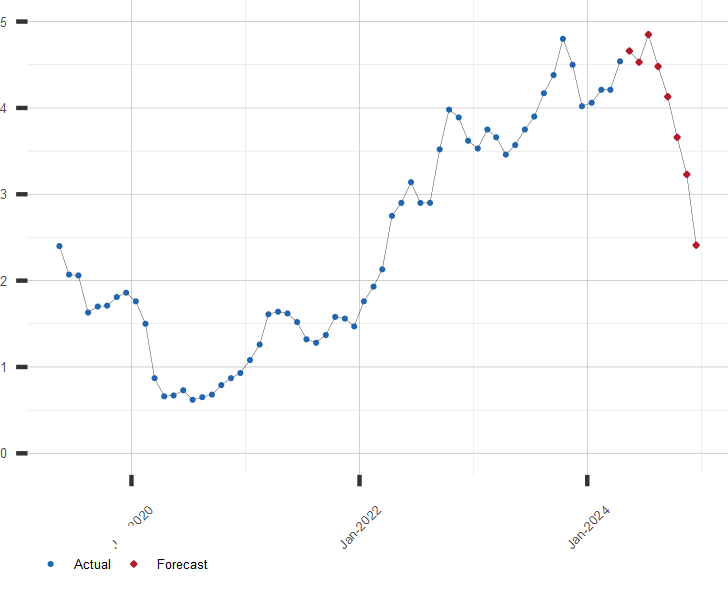

U.S. 10 Year Treasury Rate Forecast, %

Click To See All Stock Market Forecasts

Click To See All Exchange Rate Forecasts

Click To See All Interest Rate Forecasts

Click To See All Commodity Price Forecasts

Click To See All Economic Indicator Forecasts

Click To See Master List of All Forecasts

| February 18, 2026 | |

| Indicator | Value |

|---|---|

| S&P 500 | 6881.31 |

| U.S. GDP Growth, YoY % | 2.34 |

| U.S. Inflation Rate, % | 2.39 |

| Gold Price, $/oz-t | 4982.80 |

| Crude Oil Futures, $/bbl | 65.31 |

| U.S. 10 Year Treasury, % | 4.09 |