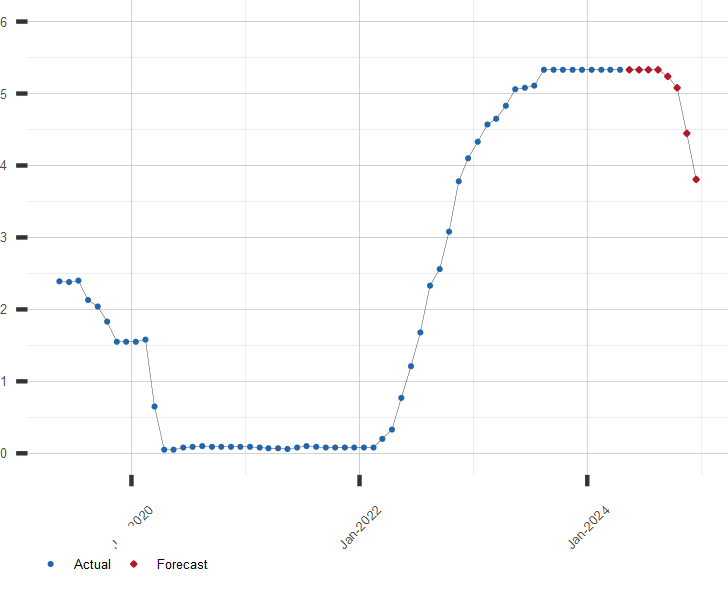

FRB Fed Funds Rate Forecast

Fed Funds Rate Forecast Values

FRB Interest Rate. Percent Per Year, Average of Month.

| Month | Date | Forecast Value | Avg Error |

|---|---|---|---|

| 0 | Mar 2025 | 4.33 | ±0.00 |

| 1 | Apr 2025 | 4.33 | ±0.08 |

| 2 | May 2025 | 4.14 | ±0.095 |

| 3 | Jun 2025 | 4.08 | ±0.10 |

| 4 | Jul 2025 | 4.06 | ±0.11 |

| 5 | Aug 2025 | 3.33 | ±0.11 |

| 6 | Sep 2025 | 3.01 | ±0.12 |

| 7 | Oct 2025 | 2.52 | ±0.12 |

| 8 | Nov 2025 | 1.58 | ±0.12 |

Get the Rest of the Story with the 5 Year Forecast!

Chart of U.S. FRB Fed Funds Rate

Percent Per Year. Includes Current Prediction.

The U.S. Fed Funds Rate

The U. S. Federal Funds Rate is the interest rate a U.S. Federal Reserve depository institution (bank, S&L or Credit Union) will charge another bank to borrow their excess reserves held at the Federal Reserve. These reserves, or Federal Funds, are traded by banks (usually overnight) to meet their reserve requirements or enable the clearing of financial transactions.

Other Interest Rate Resources of Interest:

A long range forecast for the Fed Fund Rate and similar economic series is available by subscription:

Click here to subscribe to the Fed Fund Rate extended forecast.| April 17, 2025 | |

| Indicator | Rate, % |

|---|---|

| Prime Rate | 7.50 |

| 30 Year Treasury Bond | 4.80 |

| 10 Year Treasury Note | 4.34 |

| 91 Day Treasury Bill | 4.34 |

| Fed Funds | 4.33 |

| SOFR | 4.31 |

| 30 Year Mortgage Rate | 6.83 |